There’s no denying the long-term financial benefits of owning a home, but today’s housing market may have you wondering if now’s still the time to buy. While the financial aspects of buying a home are important, the non-financial and emotional reasons are too.

Home means something different to all of us. Whether it’s sharing memories with loved ones at the kitchen table or settling in to read a book in a favorite chair, the emotional connections to our homes can be ju...

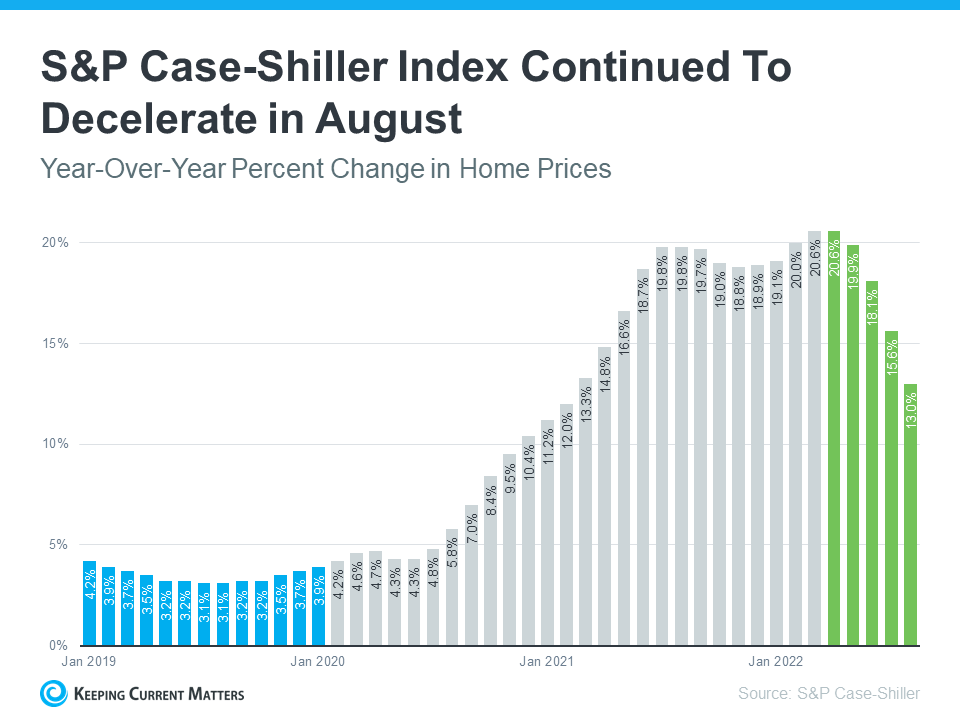

Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s true rates have risen dramatically, it’s important to remember they aren’t the only factor in the affordability equation.

Here are three measures used to establish home affordability: home prices, mortgage rates, and wages. Let’s look closely at each one.

1. Mortgage Rates

Thi...

While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home.

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too. Here are just a few trends that may benefit you when you go to buy a home today.

1. More Homes To Choose from

During the pandemic, housing supply hit a record low at the same time buyer demand skyrocketed. This...

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession.

You’re likely feeling the impact in your day-to-day life as you watch the cost of goods and services climb. The pinch it’s creating on your wallet and the looming economic uncertainty may...

As you set out to buy a home, saving for a down payment is likely top of mind. But you may still have questions about the process, including how much to save and where to start.

If that sounds like you, your down payment could be more in reach than you originally thought. Here’s why.

The 20% Down Payment Myth

If you believe you have to put 20% down on a home, you may have based your goal on a common misconception. Freddie Mac explains:

“. . . nearly a third of prospective homebuyers think the...

Rising interest rates have begun to slow an overheated housing market as monthly mortgage payments have risen dramatically since the beginning of the year. This is leaving some people who want to purchase a home priced out of the market and others wondering if now is the time to buy one. But this rise in borrowing cost shows no signs of letting up soon.

Economic uncertainty and the volatility of the financial markets are causing mortgage rates to rise. George Ratiu, Senior Economist and Manage...

Alice Kristek received the Excellence in Client Service Award from Homesnap. This achievement from Homesnap recognizes great customer service from reviews. Alice is a multiple-award-winning agent who joined EXIT in 2021. She has lived in Wausau for many years and was a past client of Glenn and Lana Mohs. Alice is known for great customer service, consistent communication, strong attention to detail, and ensuring a positive experience for all parties involved in the transaction. “We are so happy...