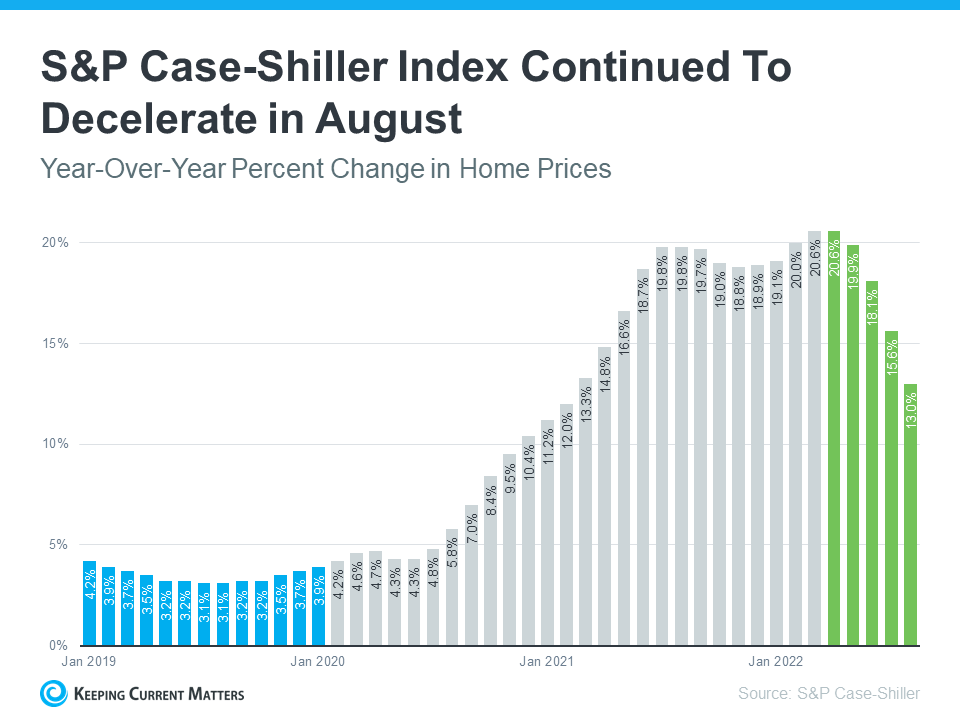

If you’re thinking about buying or selling a home, you probably want to know what’s really happening with home prices, mortgage rates, housing supply, and more. That’s not an easy task considering how sensationalized headlines are today. Jay Thompson, Real Estate Industry Consultant, explains:

“Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content...

Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s true rates have risen dramatically, it’s important to remember they aren’t the only factor in the affordability equation.

Here are three measures used to establish home affordability: home prices, mortgage rates, and wages. Let’s look closely at each one.

1. Mortgage Rates

Thi...

Stock photo by Nick Youngson.

Our friends from Fairway Home Mortgage recently let us know about a new program that helps people with student loan debt to purchase a home.

“We understand the significant role that a monthly student loan payment plays in a potential home buyer’s consideration to take on a mortgage, and we want to be a part of the solution,” Jonathan Lawless, Vice President of Customer Solutions at Fannie Mae, said on Tuesday. The policy offers homeowners the ability to pay...